Social Security disability benefits are reserved for individuals with severe medical impairments who cannot perform work at a sufficient level to support everyday necessities. The Social Security Administration (SSA) uses the term “substantial gainful activity” (SGA) to describe what a sufficient level of work looks like.

What is Substantial Gainful Activity?

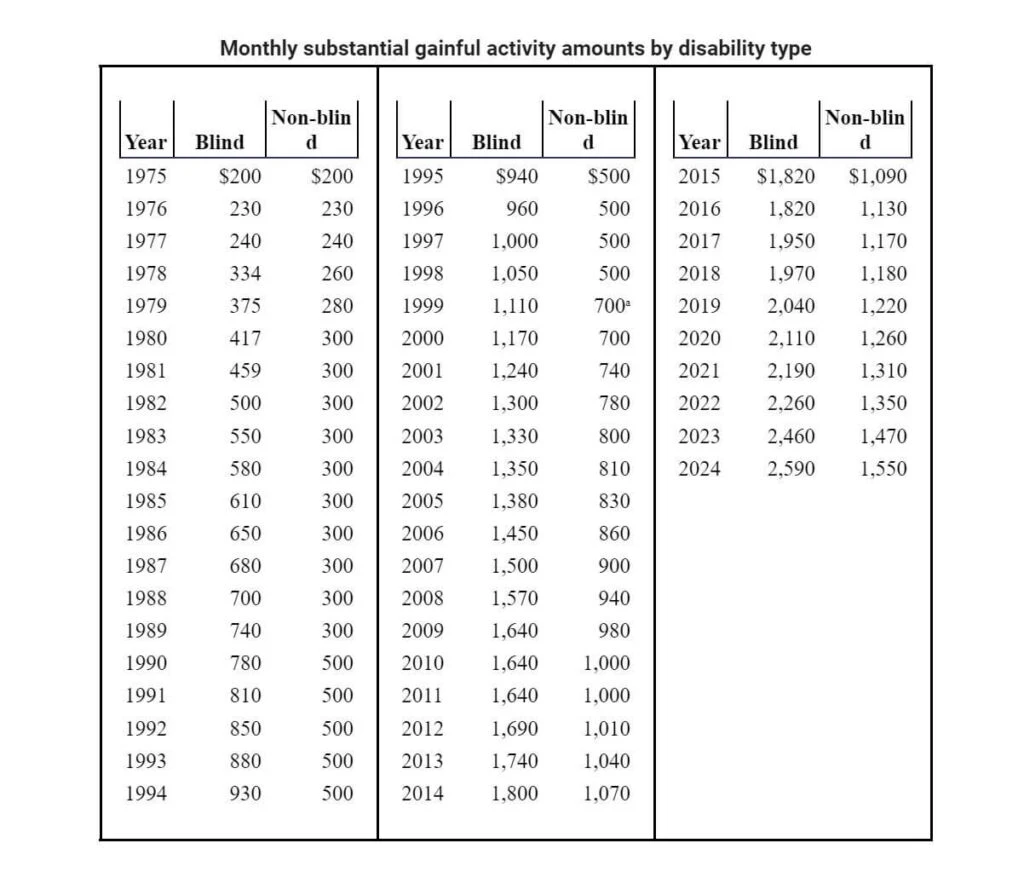

Each year, the SSA assigns a limit, called the SGA limit, to disability benefits. A person earning more than a certain monthly amount is ordinarily considered to be engaging in SGA. The amount of monthly earnings considered as SGA depends on the nature of a person’s disability. The monthly SGA amount for statutorily blind individuals for 2025 is $2700. For non-blind individuals, the monthly SGA amount for 2025 is $1620.

SGA for the blind does not apply to Supplemental Security Income (SSI) benefits, while SGA for the non-blind disabled applies to Social Security Disability Insurance (SSDI) and SSI benefits. Both SGA amounts generally change with changes in the national average wage index.

See the chart below for a history of SGA amounts in the United States.

In addition to the SGA limit, SSI payments are subject to income and asset limits. We cover those income and asset limits in detail here. In essence, the more ‘countable’ income SSA determines you have, the smaller your SSI payment will be.

Can You Get a Job While on Disability?

To summarize the above section: if you are working while disabled and your earnings EXCEED the SGA limit, you will not qualify for disability benefits. And, if you are receiving disability benefits already and your earnings exceed SGA, the SSA is notified of those earnings and will discontinue those benefits unless you’re in a trial work period (we’ll discuss that later!)

As Social Security disability lawyers in Charlotte, NC we recognize that it can be difficult to make ends meet while waiting for disability benefits to start. And that the average monthly disability payment may not be generous enough to cover all your living expenses. As a result, some claimants research what jobs hire people with disabilities and seek out additional work.

Others may qualify for disability benefits for some period of time, but as they gain access to reliable medical care through Medicare or Medicaid, their medical condition improves. In these cases, they may no longer qualify for benefits.

In the above scenarios, it’s very important for disability claimants to follow the SSA’s guidelines for returning to work. We’ll cover their most popular work incentive programs in detail below.

SSA’s Trial Work Period and Other Programs

SSA has a “Ticket to Work” program which is filled with work incentives to aid individuals receiving disability benefits in returning to work. Some work incentives apply to both SSDI and SSI programs. Others only apply to a single program.

Social Security’s Trial Work Period (TWP) is for SSDI recipients only. The TWP allows you to test your ability to work for at least nine months. During your TWP, you continue to receive your full SSDI benefits no matter how much you earn. This applies so long as you report your work activity and you have a disabling impairment.

Another popular work incentive is the ‘Expedited Reinstatement’ option. This applies to both SSDI and SSI claimants whose benefits stopped because their earnings exceeded the SGA limit.

With expedited reinstatement, claimants can request their benefits be reinstated without having to complete a new application. They may also be eligible for temporary benefits while waiting.

Last but not least, Social Security has a program called PASS designed specifically for SSI recipients. PASS is an acronym for “Plan to Achieve Self Support”. It is a written plan of action for getting a particular kind of job or starting a business. In it you identify:

- The job or business (this is your work goal).

- The steps you will take and the things you will need in order to achieve your work goal

- The money you will use to pay for these things (this may be any income– other than SSI payments– or assets, such as Social Security benefits, wages from a current job, or savings).

- A timetable for achieving your goal.

If SSA approves your PASS, they will not count the money you spend on your plan when they determine your SSI eligibility. If you are already eligible for SSI, this will increase your SSI payment, which will replace all the money you spend on your PASS.

Contact Disability Lawyers in Charlotte, NC

If you are applying for Social Security disability benefits, consult a Charlotte disability lawyer before you return to work. Everyone’s situation is unique, and a qualified disability lawyer can advise you on best next steps.