Many disability claimants ask their tax preparers the same question every tax season: is Social Security Disability Insurance taxable? The answer depends on your personal income status as well as whether you are receiving disability benefits through the SSDI or the Supplemental Security Income (SSI) programs.

Below, we cover five things you need to know about filing your taxes while receiving Social Security Disability benefits.

Do You Have to File Taxes on Social Security Disability?

Tip #1: Determine if you are receiving SSDI or SSI disability benefits. The SSI program is needs-based. It has strict income and resource limits that individuals must meet to qualify for benefits. Because the benefit population has a low-income threshold, SSI benefits are NOT taxable. If you receive SSI disability payments through SSI, you do not owe taxes on those benefits.

Tip #2: Include all your Social Security Benefits, not just SSDI benefits. Social Security benefits include monthly retirement, survivor and disability benefits. If you are receiving SSDI benefits, those benefits will count towards any income limits which apply to calculating your tax burden. Individuals receiving full Social Security retirement benefits at full retirement age will no longer qualify for SSDI benefits.

But those who elect to receive early Social Security retirement benefits or who receive survivor benefits from a spouse need to include those amounts along with their SSDI payments in their annual calculation of benefits. If that’s the case, simply calculate the total dollar amount of benefits you’ve received for tax purposes. The amount should align with the amount listed in Box #5 on the annual Form SSA-1099 that you receive each January from the Social Security Administration.

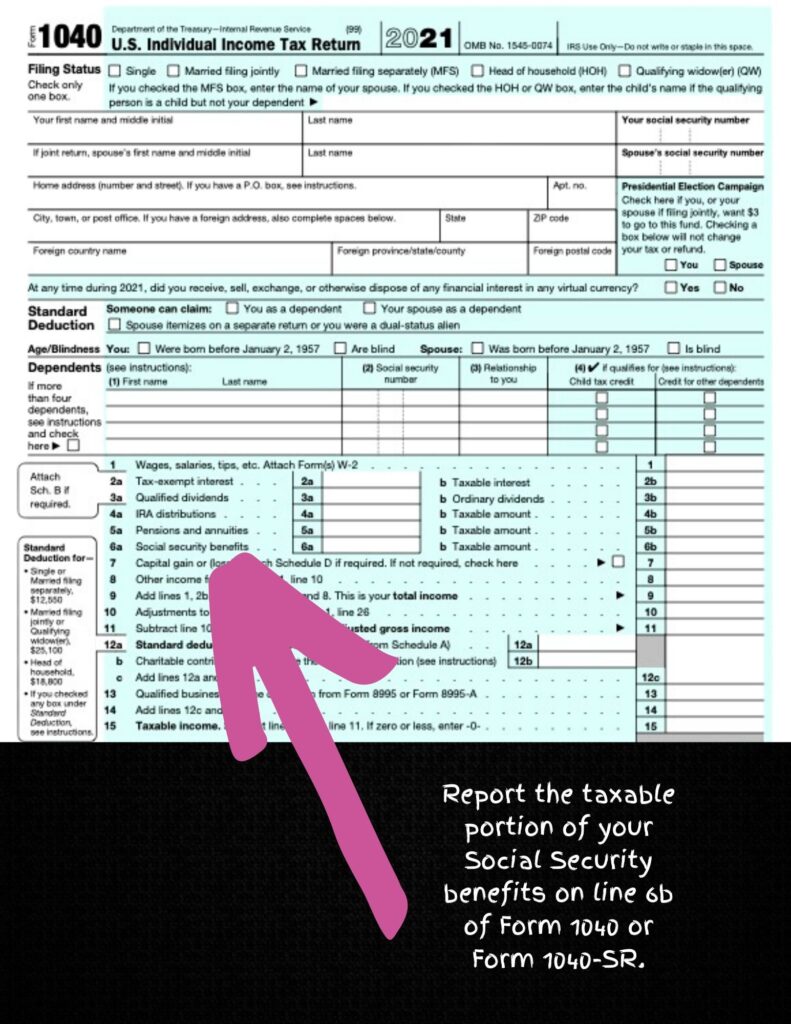

Tip #3: Submit Form 1040, or Form 1040-SR. Once you calculate the total amount of Social Security Benefits you’re receiving, you need a way to report that information to the IRS. The way to do this is to complete Form 1040, U.S. Individual Income Tax Return. If you are older than 65, you will submit Form 1040-SR, U.S. Tax Return for Seniors.

The taxable portion of the benefits included in your income and used to calculate your income tax liability depends on the total amount of your income and benefits for the taxable year. You report the taxable portion of your Social Security benefits on line 6b of Form 1040 or Form 1040-SR.

Tip #4: Seek out a professional tax preparer. If you have questions or concerns regarding the above or if it’s your first year receiving disability benefits, we recommend you contact a professional tax preparer. While disability lawyers have knowledge specific to the disability programs, income and resource limits, you should not use your attorney’s guidance as a substitute for tax advice from a licensed professional.

Below, we’ll walk you through a rough calculation and provide you with online resources for calculating any taxes you may owe.

Calculating the Taxable Amount of Disability Benefits

Your benefits may be taxable if the total of 50% of your monthly benefit payments, plus all your other household income, including tax-exempt interest, is greater than the base amount for your filing status.

As of tax year 2021, the base amount for your filing status is:

- $25,000 if you’re single, head of household, or qualifying widow(er),

- $25,000 if you’re married filing separately and lived apart from your spouse for the entire year,

- $32,000 if you’re married filing jointly,

- $0 if you’re married filing separately and lived with your spouse at any time during the tax year.

If you file a joint return, you and your spouse must combine your incomes and Social Security benefits when determining the taxable portion of your benefits. Even if your spouse didn’t receive any benefits, you must add your spouse’s income to yours on a joint return when determining if any of your benefits are taxable.

Form’s 1040 and 1040-SR walk you through this calculation, but the IRS also has an online tool to help you determine any tax obligation you may have. You can access their online tool here. Before you begin, you’ll need basic information to help determine your gross income as well as the amounts from Box 5 on Form SSA-1099. This is the form Social Security sends you in January each year to report benefits paid during the current tax year.

Please note, if you made contributions to a traditional Individual Retirement Arrangement (IRA), you’ll need to take other calculations into consideration. This rule also applies to individuals covered by a retirement plan at work or through self-employment. If that’s the case, use the worksheets in Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs), to see if any of your Social Security benefits are taxable.

Disability Lawyers in Charlotte NC

This information is provided by Collins Price, PLLC, a Charlotte, NC disability law firm serving claimants applying for disability, appealing a denied claim or attending a disability hearing. Our disability lawyers in Charlotte, NC are not tax professionals and the advice offered above is not a substitute for tax advice from a licensed tax professional.

If you or someone you know cannot work due to a severe physical or mental impairment, contact us today for a free consultation on your claim.