Do I Qualify for Social Security Disability Benefits?

Are you unable to work due to an injury, illness, or mental condition?

Have you been, or do you expect to be, out of work for 12 months or more?

The Social Security Administration uses a 5-Step sequential evaluation when determining eligibility for disability benefits. Any severe medical impairment or combination of impairments (physical, mental or cognitive) that seriously impacts your ability to perform work-related activities on an ongoing and continuous basis may meet the criteria for Social Security Disability benefits.

Disability is defined as an inability to perform any “substantial gainful activity.” This means you must be so disabled that you cannot perform any type of full-time work activity. This standard begins to relax as you get closer to retirement age eclipsing 50 and 55 years of age.

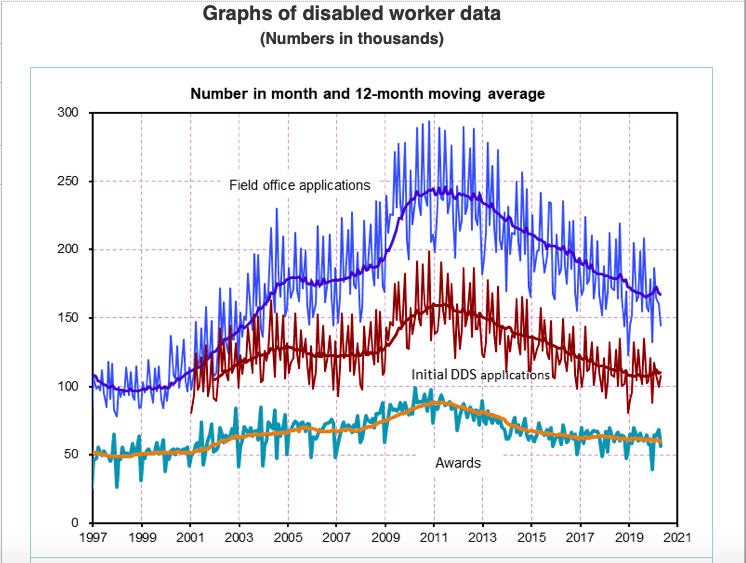

If you answered ‘yes’ to the questions above, you might be eligible to receive Social Security Disability benefits. As you can see in the graph below from Social Security’s website, Social Security receives hundreds of thousands of applications each year, and only pays benefits to a small portion of those claimants. That’s why it’s very important to present the strongest disability benefit claim possible and to work with a qualified Social Security Disability lawyer.

SSDI or SSI – what’s the difference?

The Social Security Administration (SSA) administers the Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) programs. These programs have the same definition of disability, but have different eligibility requirements.

Social Security Disability (SSDI)

Social Security Disability (SSDI) is a Federal insurance program designed to help people with disabilities who are no longer able to work because of one or more severe medical conditions. Disabled workers are eligible to apply for SSDI if they have worked long enough and earned sufficient wages over the past 10 years. The number of work credits you need to qualify for Social Security Disability benefits depends on your age when you become disabled. Generally, you need 40 credits, 20 of which were earned in the last 10 years ending with the year you become disabled. However, younger workers may qualify with fewer credits. Furthermore, if your employer did not report your wages to SSA or file FICA taxes, you may not be credited with the necessary quarters. If you have worked for cash and did not report those wages or pay taxes, you will be disadvantaged in establishing enough quarters of coverage.

How do I pay FICA taxes?

Most workers have FICA taxes withheld directly from their paychecks. These deductions claim 6.2 percent of an employee’s gross pay for Social Security, up to an income threshold commonly termed “maximum taxable earnings.” In 2021, the threshold is $142,800; any earnings above that are not subject to Social Security taxes. The limit is adjusted annually based on national changes in wage levels.

There is no comparable earnings maximum for Medicare; the 1.45 percent Medicare tax included in FICA is levied on all of your work income. Employers match workers’ Social Security and Medicare contributions.

If you are self-employed, you are subject to SECA (the Self-Employed Contributions Act) and contribute in a similar way to the SSDI program when you file your annual taxes.

Learn more about FICA and the history of the SSDI program in the United States.

Supplemental Security Income (SSI)

Supplemental Security Income (SSI) is a financial needs-based program for disabled individuals with income and assets below a certain level.

We also help with:

Childhood SSI

If your child has an illness or condition which qualifies them as disabled by the Social Security Administration (SSA), they may be qualified to receive benefits.

Disabled Widow’s Benefits

If a disabled person passes away while receiving Social Security benefits, the surviving spouse may be eligible to continue to receive those benefits.

Representation through every stage of your claim!

APPLICATIONS

Hire a licensed Social Security Disability attorney to help you file your initial disability application.

HEARINGS

Don’t face your disability hearings alone. We’ll help you prepare and fight for the benefits you’ve earned.

APPEALS

Most disability applications are denied the first time and have a small window of time to appeal. We’ll guide you through the appeals process.

Who Can Apply for Disability Programs?

North Carolina Disability Requirements

A person is “disabled” according to SSA if they have a severe medical impairment or combination of impairments lasting or expected to last 12 months or more. During that year, your condition must prevent you from working and earning what is considered “substantial and gainful” income. While many of our clients are over age 50, injury or illness can impact a person at any stage of their life.

If you have earned sufficient work credits for SSDI or meet the financial need-based criteria for SSI benefits, you may qualify for benefits any time prior to full retirement (66-67 for most people).

At Collins Price, PLLC, we’ve successfully handled disability claims for clients from ages 2 to 67. If you aren’t sure whether or not you qualify, your first step is to contact a Social Security Disability attorney. Collins Price, PLLC serves Charlotte, NC, Winston-Salem, NC, Greensboro, NC and surrounding areas with offices conveniently located in Winston-Salem, Mount Airy, and Lexington. To us, you’re more than a case number. We want to get to know you and help you get the support you need.

Can’t Travel? We’ll Come to You!

We’re proud to serve clients all across North Carolina. We’ve handled cases from the mountains of Franklin, NC to the beaches in Wilmington. If you don’t live near an office, our Social Security Disability attorneys are flexible and can handle many issues through the mail or over the telephone. If you can’t travel and a deadline is looming, we’ve been known to make house calls as well.

A Step-By-Step Explanation of the Appeals Process:

- Initial application. This can be done online, over the phone, or in person by contacting your local Social Security Administration office. It will take approximately 3-6 months to receive a decision and most initial applications are denied.

- Reconsideration This is an appeal of the initial denial, and it involves filling out a form provided by the Social Security Administration and updating the claimant’s medical record. This process take several months to complete. Nationally, approximately 9-13% of Social Security Disability claims are approved at reconsideration.

- Hearing. Most people who are awarded disability benefits receive them at this stage. Hearings are held by Administrative Law Judges in Greensboro, Charlotte, Raleigh and Fayetteville. Thorough medical records along with supportive letters from doctors are essential to prevailing. An Administrative Law Judge will evaluate your case based upon the medical evidence you present and the testimony you provide.

We help our clients at every stage of the Social Security Disability process, from filing an initial application, to appealing a denial, and representing you in front of Social Security’s administrative law judges.

Every case starts with a free, no obligation consultation.

(336) 793-9680

We don’t get paid unless you do. Click below or call us today for a free case evaluation.